Services

Process Flow Chart

1 Intake

Team

2 Demographic & Eligibility Verification

3 Coding & Charge Entry

4 Claim Submission & Rejection

5 Payment & Denial Posting

6 Denial & AR Management

7 Patient Statement & Collection

8 Daily & Month End Reporting

Intake Team

Provider Office Upload Paper Work Through Different Platform

Intake Team Receive Paperwork and update WLT

- We receive paper work from Provider office via FTP/Drop Box or EHR portal.

- Once received a daily WLT (Work Load Tracker) is maintained by the team.

- Daily Tracker share with Provider office on daily basis or as per request.

Demographic Entry

Patient Registration Services

- Entry of Patient's Demographic Information

- Capture of Healthcare Insurance Information

- Documentation of Medical Information such as allergies, medication, and special assistance needs

- Review and Capture of Payee Contact information

- Once paperwork received from Intake team, work is allocated to the team.

- Demographic Information is entered in the system along with Insurance details.

Eligibility Verification

Eligibility Verification and Prior Authorization

Receive Patient Schedule from Provider's Office

Entry of Patient's Demographic Information

Verify coverage of benefits with the patient's primary and secondary payers

Where required, initiate prior authorization requests and obtain approval for the treatment

Update the hospital's revenue cycle system or the patient's practice management system

- Once demographic entries is completed, we check eligibility & benefits from the payer.

- If patient is not eligible then we call the patient or escalate to Provider Office formore details.

- Prior Authorization is obtained if needed.

- After Patient details are verified, it’s forwarded to charges team.

Charge Entry

Charge Entry Process

Routing of scanned Super bills to team members

Review Patient Demographics information and post ICD/CPT codes and corresponding charges

Submit completed claims to the payer via a clearinghouse

Quality Assurance to ensure accuracy SLA is exceeded consistently

Charge Entry includes data entry of charges and conversion of electronic charges/visits toclaims-related activities.

- All charge entry is performed by the Charge Entry Department at by assigning batches from the Charge Entry WLT to analysts based on production and quality metrics.

- Verify information entered by the Demographic team and enter CPTs and ICD codes based on inputs from Coding Team.

- Charge Entry converts the data captured to claims and batch is created which is latersubmitted to Clearing House.

Claims Rejection

Work Edits and Claims Rejecttion Management

Edits on the Practice Management System

Prior to claims being staged to claims scrubber application, we review the clams using the system functionality.

Bill Scrubber Edits

Automated claims editing to ensure that the claim data is accurate and manual edits as needed.

Clearinghouse Edits

We review all claims throwing out from the clearinghouse systems and manually resolve.

Payer Rejections

Once the claims reach the payer, the claims are in denied or partially denied status and upon receipt of the information, we work with payers to refile claims.

- Once claim issubmitted to the clearing house, team keep a track of rejections on daily basis.

- If claim is rejected our specialized team resolve the issue & submit them to clearing house.

Claims Rejection

Work Edits and Claims Rejecttion Management

Edits on the Practice Management System

Prior to claims being staged to claims scrubber application, we review the clams using the system functionality.

Bill Scrubber Edits

Automated claims editing to ensure that the claim data is accurate and manual edits as needed.

Clearinghouse Edits

We review all claims throwing out from the clearinghouse systems and manually resolve.

Payer Rejections

Once the claims reach the payer, the claims are in denied or partially denied status and upon receipt of the information, we work with payers to refile claims.

- Once claim issubmitted to the clearing house, team keep a track of rejections on daily basis.

- If claim is rejected our specialized team resolve the issue & submit them to clearing house.

Payment Posting

Payment Posting Process

Patient Payments

Processing of payments made by Patients via cash/check/credit cards for co-pays, deductible, or for non- covered services.

Insurance ERAs

Batch processing of electronic remittance advisory (ERA), and correction of any exceptions and transfer of balance to secondary insurers

EOB Processing - Manual

Processing of payments made by insurance companies without ERA, and transfer of balance to secondary insurers

Denial Posting

Posting of denials and re-billing to secondary insurance company, transfer the balance to the patient, write-off the amount, or send the claim for reprocessing

Payment posting process includes correct posting of payment or denial and transferring remaining balance to corresponding responsible parties (Secondary/Tertiary Insurance or Patient).

There are 2 types of payment which we receive:

- Patient Payment

- Insurance Payment

Two types of Remittance Advice we receive from the insurance:

- Paper EOB

- ERA/EFT

Paper EOB posting:

Once a batch is created, we are ready to post payment received under EOB batches. All the critical information is manually entered into the system against each account & DOS as per the Insurance EOB. Once, the batch has been adjusted with the payment amount/adjustment amount/patient responsibility we close the batch.

Electronic Posting (ERAs):

We post ERAs on a daily basis once we will receive them in the system from the payer end. ERAs we use to post are for till current date only and should be on ACH/Non Payment mode only. We did receive payments for the future date as well but do not use to post these ERAs in the current day and transfer the balance to secondary/tertiary insurance or onto the patient.

Denial Posting:

If the claim is denied, the payment poster enters the denials reason code on the particular DOS code and creates a task for the denial management team, and no need to transfer the balance to sec ins or onto the patient bucket.

Reports:

We can track our processed work thru Reports. Reporting is a major part of the posting. After running reports, we have to verify that all the transaction which are coming up in the report is accurate and as per the requirement, guidelines and protocol everything is fine in the batch for which we have the report. Mainly after the completion of the Batch we use to run today’s Journals and Journal Summary.

Denial Management

Accounts Receivable Management Process

Track Status

Follow up with the insurance company to track the status of the claims

Identify Denial Issues

We identify denied claims, to analyze the reasons, follow-up with insurance company to check if additional information is needed and address the issues.

Refile the claim

Refile the corrected claim to the insurance company and initiate follow up plan. At times, we may need to bill the secondary insurer.

Resolve the Claim

Track the status of the claim with the insurer and follow-up till the claim is resolved.

Once the payment team has entered the denials into the system with the claims adjustment reason codes, the supervisor must retrieve the report from the system and assign it to the denials team to resolve the denials using the four steps:

- Identify – Identify and correct the issues that cause claims to be denied by insurance.

- Manage – Classify denials by reason, source, cause, and other distinguishing factors.

- Monitor- Monitor the denials and develop and assess effective denial management strategies, maintain a log of denials to ensure that your denial management processes are effective. Audit the work of users by selecting a sample of their work and also make sure the team has the tools, technology, and resources to get the job done.

- Prevent – Implement strategies, Sort denials by category to determine the potential opportunities to revise processes, adjust workflows, or re-train employees, physicians, and providers.

After reviewing the denial and resolving the issue, the team resubmits the corrected claim to insurance by entering the correct resubmission code 7 with the original ICN, or if the claim is incorrectly denied or the issue can be resolved over the phone, they call insurance and ask the representative to reprocess the claim, capturing all relevant information in notes and entering it into the system.

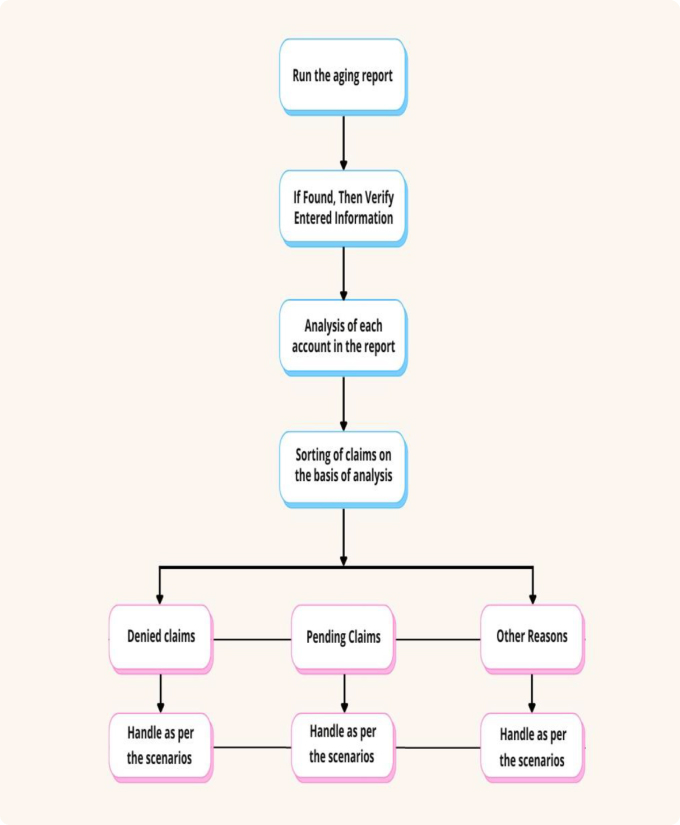

AR Management

Accounts Receivable Management Process

Track Status

Follow up with the insurance company to track the status of the claims

Identify Denial Issues

We identify denied claims, to analyze the reasons, follow-up with insurance company to check if additional information is needed and address the issues.

Refile the claim

Refile the corrected claim to the insurance company and initiate follow up plan. At times, we may need to bill the secondary insurer.

Resolve the Claim

Track the status of the claim with the insurer and follow-up till the claim is resolved.

To obtain an accurate understanding of the claims’ status, we use multiple contact channels with insurance companies – website, fax, IVR, and phone. We keep track of the ageing bucket of A/R and know when the payers will have the information on file. We initiate follow-up calls within the appropriate number of days after claim submission to avoid wasting time followingup with payers before the deadline.

Types of AR:

- Insurance AR

- Patient AR

Basic Rule for AR Follow-up

Supervisor always encourage team to follow basic rules of follow before dialing to insurance company

- Pre-Call Analysis

- On Call Analysis

- Post Call Analysis

Our work does not end with obtaining the claims’ status. We go a step further and initiate actions such as claim refiling and appeals to receive reimbursements, as well as perform analytics with a focus on reducing days in A/R.

AR Management

Example:-

Claim is in the process: – Called Ins Name @ Ins Number s/w Representative Name

Claim received to date

May I know how many days it may take to process the claim

If the received Date is more than 30 days then need to ask below questions

The reason for the delay

The patient is effective and termination date

How much time it will take to process the claim

May I know the claim#

May I know the call ref#

Patient Statement & Collection

Patient Statement Generation Services

Electronic Statements

Generation of electronic statement and mailing to the patient.

Printed Statements

We log into the practice management system and print the statements for onward mailing to the patients.

Payment poster transfer the patient responsibility into patient bucket if they don’t have secondary insurance/tertiary insurance. Supervisor pull the report monthly and identify the accounts on which balance is in patient bucket and assign user to work on accounts

- Statement sends to patient in every 30 days.

- 3 statements send to the patient

- After 3 rd statement a letter send to the patient stating if they don’t pay the balance, we send your account to the collection agency or follow up as per client guideline.

Patient Payment Received via:-

- Paper Check: - Patient can send paper check on the facility address.

- Credit Card: - Patient can call and ask charge their card.

- Online Payment: - Patient has option to pay their bill online.

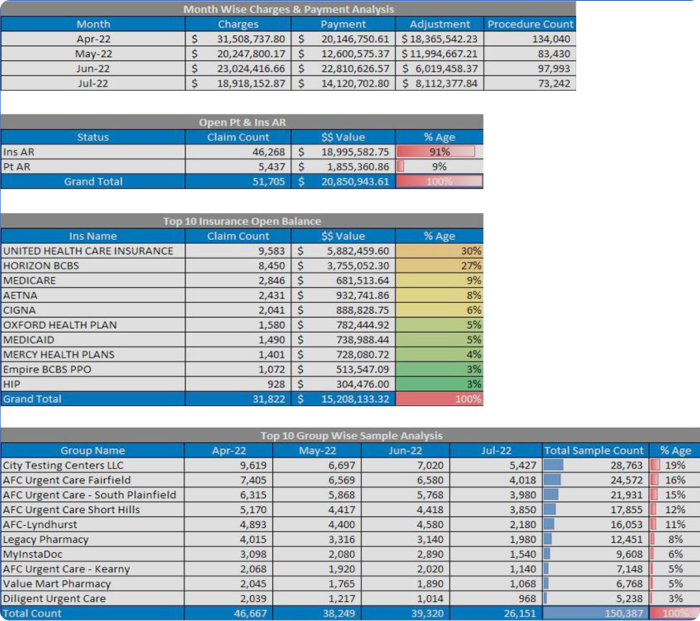

Month End Reporting

- Payment & Charges Report

- Location Wise Report

- Credit Balance Report

- Doctor Wise Report

- Insurance Wise Report

- CPT Wise Report

- Insurance & Patient AR Report

- Comparison Report